Apply for the WBSO subsidy 2024

Get the maximum benefit from your WBSO application in 2024. Read more about the benefits this tax arrangement can offer your company. Want to know immediately how much benefit you can get from the WBSO scheme? Schedule an appointment with a consultant.

Get the maximum benefit from your WBSO application in 2024. Read more about the benefits this tax arrangement can offer your company. Want to know immediately how much benefit you can get from the WBSO scheme? Schedule an appointment with a consultant.

- 1. What is WBSO?

- 2. Who is the WBSO for?

- 3. Software and manufacturing industry

- 4. What does the WBSO yield?

- 5. Applying for WBSO in 2024?

- 6. WBSO budget 2024

- 7. Settle WBSO

- 8. Keep track of your WBSO administration

1. What is WBSO?

The Promotion of Research and Development Act (WBSO), implemented by the Netherlands Enterprise Agency (RVO), stimulates technical innovation within the Dutch business community. By technical innovation we mean the technical development of new products, production processes or software, carried out within your own company. Thanks to the subsidy, the self-employed and companies receive a contribution towards the wage costs of employees who work on Research and Development projects, also known as Research & Development (R&D) projects.

2. Who is the WBSO for?

The WBSO is intended for all Dutch companies that are liable to pay income tax, but also for independent entrepreneurs and sole proprietors who are liable to pay income tax and develop something new technically. With this subsidy you can reduce the monthly wage costs. To be eligible for this, the development must be technically new for your company and must be developed in-house. It is important that the developments still have to take place. This subsidy scheme does not have retroactive effect. It is important that developments will still have to take place.

3. Software and manufacturing industry

WBSO funding is available for each sector, as long as innovation takes place. However, we apply for the above tax arrangement for software projects, and projects in the manufacturing industry in particular.

4. What does the WBSO yield?

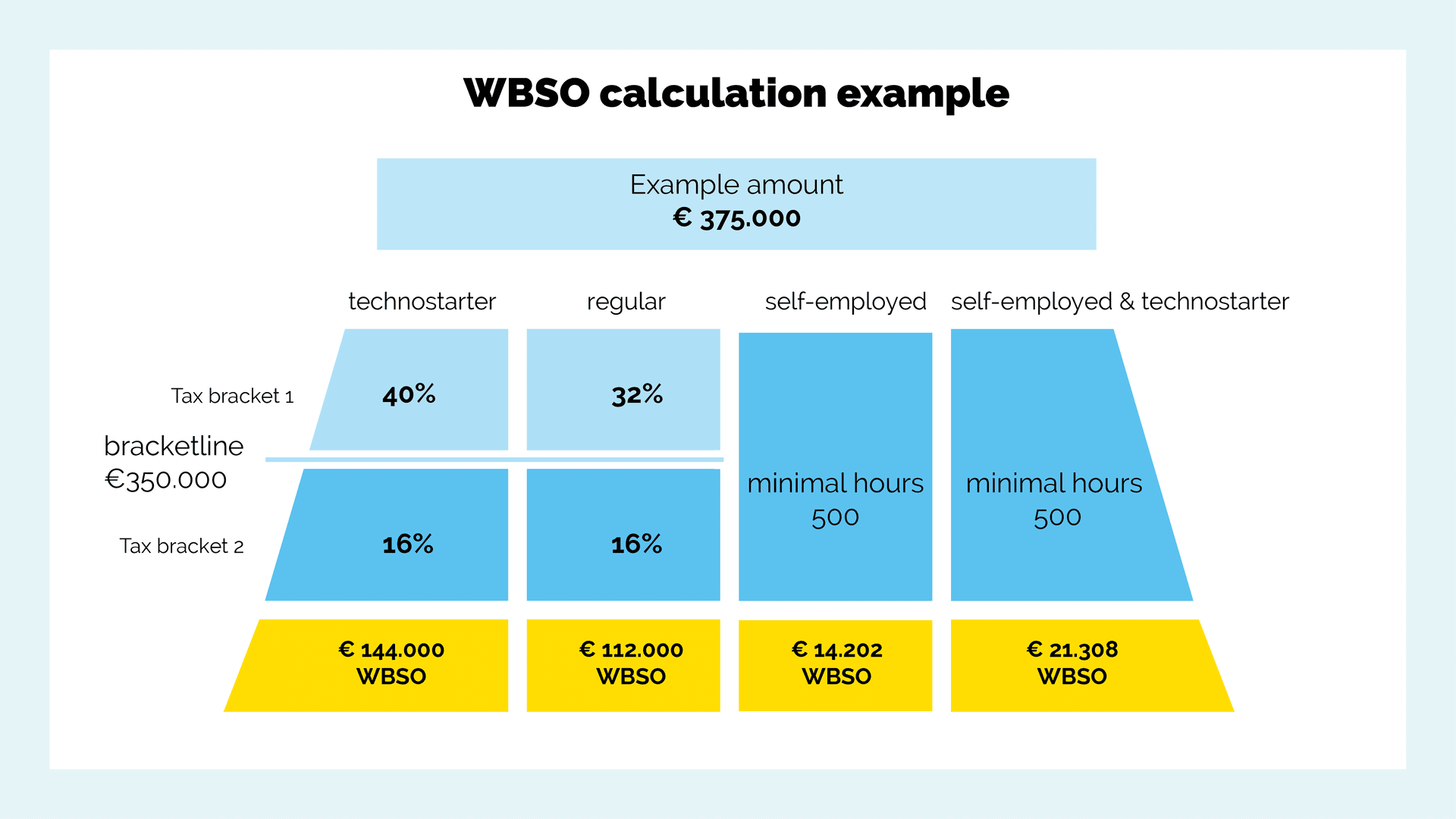

- 32% of the R&D amount attributable to projects of up to €350,000 (1st bracket)

- 16% of the R&D amount attributable to projects above €350,000 (2nd bracket)

- 40% for techno-starters (companies registered with the Chamber of Commerce for less than 5 years, and max. 3 years of WBSO subsidy obtained) for the 1st bracket. The percentage of the 2nd bracket is 16%

For your first application in a calendar year, you choose whether you should declare R&D costs and expenses, or whether you opt for an increase in the R&D hourly wage. For the self-employed, there is an increase in the self-employed deduction. This deduction amounts to €13,360 in 2022 and there is an additional deduction for a techno starter of €6.684. To be eligible for this, a self-employed person must spend at least 500 hours on eligible activities.

5. Applying for WBSO in 2024?

You can apply for the WBSO scheme yourself at the eLoket of the Netherlands Enterprise Agency, but it takes a lot of time and energy. We can do that better and faster. The application must then comply with the rules and expectations of RVO, whereby the desired technical level and the associated formalities are experienced as difficult.

The WBSO is a tax arrangement. The entire WBSO process looks like this:

- Make an inventory of WBSO projects

- Collect relevant documents

- Work out and submit a WBSO application

- Keep R&D administration

- Answer all questionnaires from RVO.nl

- Receive WBSO statement

- Implement the WBSO benefit via payroll tax

- Submit a possible objection and attend a hearing

- Take care with your final settlement for the past subsidy year: hours and BSN report

- Possibly undertake an inspection visit to RVO.nl

- Advising on other subsidies and financial opportunities for innovation

6. WBSO budget 2024

In 2024, € 1,370 million available for the WBSO.

7. Settle WBSO

If the WBSO application is (partially) assessed as positive, you will receive an R&D statement with the decision. This contains the amount that may be deducted from wage payments. Now, you can calculate your financial benefit. There are two options:

- You are an R&D withholding agent and you receive an R&D withholding tax credit. You deduct the remittance reduction from your payroll tax return.

- You are an R&D taxpayer and you receive an R&D deduction. In this case you can claim the amount with the income tax return for the year to which your R&D statement relates.

How can I receive a WBSO statement faster?

By submitting a complete WBSO application directly, the application can be processed faster at the RVO. The completeness of the application is also important. Therefore, provide the citizen service numbers (BSNs) for the application. These are necessary for calculating the R&D hourly wage.

Do you want to submit a WBSO application yourself?

Of course you can also apply for the WBSO subsidy yourself at the eLoket of the Netherlands Enterprise Agency. The application must then comply with the WBSO rules and expectations of RVO, whereby the desired technical level as well as the formalities surrounding it are considered difficult. Since we have more than 40 years of experience in this field and we submit 1500 to 2000 applications every year, we are happy to take this off your hands. Within one hour we provide insight into your WBSO opportunities and we offer suitable subsidy advice. It is important to know that the WBSO cannot be applied for retroactively.

WBSO subsidy already arranged?

Have you already applied for a WBSO subsidy or are you using another consultant for this? We offer the possibility of a free second opinion, during which we clearly identify whether there is more to be gained from the WBSO. Contact us for an informal conversation. We also have a lot of experience with English-language WBSO applications.

Have your WBSO project reviewed

Are you curious how your WBSO application can be optimized? Have an expert review your project for free. We are happy to provide you with concrete tips that you can use right away.

No cure, no Pay

We apply for WBSO subsidies according to the no cure, no pay principle. If the subsidy is not awarded, your subsidy advisor will not charge you any costs.

8. Keep track of your WBSO administration

If you receive a WBSO statement, as an employer you are obliged to keep a balanced R&D administration and to report the actual R&D hours after the end of the subsidy year. The WBSO administration provides a clear overview of the nature, content, progress and scope of the R&D work performed per project. If several companies are involved in a project, then each company must keep separate records.

A verification visit by the RVO

The Netherlands Enterprise Agency schedules random checks for companies that use the WBSO subsidy. When your company is selected for this, it can be quite overwhelming. Therefore, make it easy for yourself and the assessor and prepare well for this. Ensure good project administration and discuss with your DB&P consultant matters that may require extra attention.

Want to receive a WBSO question letter?

After your WBSO application has been submitted to the RVO, you will receive a positive WBSO statement, a negative WBSO statement, or a partial award no more than three months after the initial date of the application period. However, the RVO may still have questions regarding your application. In most cases this is done in writing, in the form of a questionnaire. This must be answered within two weeks. DB&P customers are supported in answering the questionnaire.

WBSO hearing

If your WBSO application is rejected after answering the questionnaire, you can object to this. This leads to a hearing. During the hearing you will elaborate on the project and explain its technical details. On average, 50% of objections are approved after a WBSO hearing.

Average WBSO benefit

Want to know whether your project qualifies for the WBSO or how much WBSO subsidy you can apply for?